The terms Profit and Loss are used in businesses. In business transactions, goods are purchased and sold. The price used to purchase is called “Cost Price” and written as CP. The price obtained by selling goods is called “Selling Price” and it is written as SP.

********************

10 Math Problems officially announces the release of Quick Math Solver and 10 Math Problems, Apps on Google Play Store for students around the world.

********************

********************

If the selling price of certain item is more than the cost price, then there is a profit. If the cost price of certain item is more than its selling price, then there is a loss. For example:

-

An article is bought for Rs.

500 and sold it for Rs. 600. Here, SP is more than CP, so there is a profit of

Rs. 600 – 500 = Rs. 100

- An article is bought for Rs. 1000 and sold for Rs. 800. Here, CP is more than SP, so there is a loss of Rs. 1000 – 800 = Rs. 200

As stated in the examples above,

If SP>CP, there is a profit and it is

obtained as

Profit (P) = SP – CP

If CP>SP, there is loss and it is

obtained as

Loss (L) = CP – SP

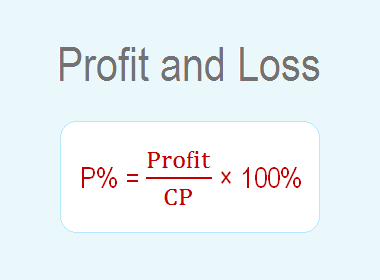

Profit and loss percent is calculated on the basis of cost price (CP). So,

The formula of CP, SP, Profit, and Loss:

How to solve the problems related to Profit and Loss?

While solving the problems related to

profit and loss we must use the following steps:

i.

Understand the problem and

make planing.

ii.

Solve problem according to

the planing.

iii. Review solved problem and recheck it.

iv. At last, write the conclusion according to the question.

Worked Out Examples

Example 1: Mrs. Sarala bought a Banarasi

Sari at Rs 3500. After one month, she was interested to have a new one and

hence she sold it for Rs. 3200. Find her loss percent.

Solution: Here,

∴ Her loss percent is 8.57%.

Example 2: Sabin bought 14 copies for Rs.

140 and sold 8 copies for Rs. 96. Find his profit or loss percent.

Solution: Here,

∴ He

has got a profit of 20%.

Example 3: An exercise book cost Rs. 20. If it is sold at a profit of 10%, find its selling price.

Solution: Here,

∴ The selling price of that exercise book is Rs.

22.

Example 4: If a shopkeeper sells a shirt for Rs. 270 at a loss of 10%, for what price should it be sold, so as to get a gain of 30%?

Solution: Here,

∴ The shirt should be sold at Rs 390 to get a profit of 30%.

Example 5: Salman sold a DVD at a gain of

8%. Had it been sold for Rs. 75 more, the gain would have been 14%. Find the

cost price of the DVD.

Solution: Here,

Hence, the CP of the DVD is Rs. 1250.

Do you have any questions regarding the Profit and Loss?

You can ask your questions or problems in the comment section below.

A man allows a discount of 10% on a book whose marked price is ₹40. What is the cost price so that the profit is 20% ?

ReplyDeleteSolution: Here,

DeleteMP = ₹40

Discount = 10%

SP = (100 – d%)MP/100 = (100 – 10)40/100 = 90×40/100 = ₹36

Profit = 20%

CP = 100SP/(100+P%) = 100×36/(100+20) = 3600/120 = ₹30

∴ The cost price is ₹30. Ans.

price of a pen is 240 with discount perfect of 5%. What amount shoult be paid when discount would be 10%?

ReplyDeleteSolution: Here,

Delete1st Case,

SP = 240

Discount = 5%

MP = [100/(100-d%)] × SP = [100/95] × 240 = 252.63

2nd Case,

MP = 252.63

Discount = 10%

SP = [(100-d%)/100] × MP = [90/100] × 252.63 = 227.36

∴ 227.36 should be paid.

Unless money gets decentralized and stays fungible, the authority on public money steals an increasing part of its value by controlling its representation. This article introduces the reasons for that: it explains the advent of governments along with their central banks, then why only the decentralization and fungibility of money can consistently preserve the ownership of monetary value. bitcoin profit

ReplyDeleteAn article was sold for 10% discount there is a profit of 5%.if the same article is sold at 5% discount there will be Rs 251 profit.find the marked price and cost price

ReplyDeleteSolution:

DeleteHere,

MP = Rs. x (let)

1st Case,

Discount = 10%

∴ SP = (100-d%)/100 × MP = 90x/100

Profit = 5%

∴ CP1 = 100/(100+P%) × SP = 6x/7

2nd Case,

Discount = 5%

∴ SP = (100-d%)/100 × MP = 19x/20

Profit = Rs. 251

∴ CP2 = SP – Profit = 19x/20 – 251

But, CP is the same,

∴ CP1 = CP2

i.e. 6x/7 = 19x/20 – 251

or, 6x/7 = (19x – 5020)/20

or, 120x = 133x - 35140

or, 120x – 133x = – 35140

or, -13x = -35140

or, x = -35140/-13

or, x = 2703.07

∴ MP = x = Rs. 2703.07

∴ CP = 6x/7 = Rs. 2316.90

https://www.visualaidscentre.com/service/eyes-specialist-delhi/ Every gamer goes through the process of buying a new video game - playing it to boredom or completion and then moving onto the next game. For some, the retail value of 40 pounds (60 dollars) for most new video games makes moving onto the next game a tricky task, making gaming an expensive hobby! This article will discuss several methods of buying/getting new video games available to gamers and consider whether video game swapping sites represent the best possible value to a gamer when moving onto a new video game.

ReplyDeleteA man bought two school bags for RS.2020.He sold one of them at 20% profit and the other at 20% loss.Find his gain or loss percent in this transaction if the selling prices of both bags are same.

ReplyDeleteSolution: Here,

DeleteTotal CP = Rs. 2020

For 1st bag,

CP = Rs. x (let)

Profit = 20%

∴ SP = (100+P%)CP/100 = (100+20)x/100 = 120x/100 = 6x/5

For 2nd bag,

CP = Rs. 2020 – x

Loss = 20%

∴ SP = (100 – L%)CP/100 = (100 – 20)(2020 – x)/100 = (8080 – 4x)/5

Both the SP are same,

∴ 6x/5 = (8080 – 4x)/5

Or, 6x = 8080 – 4x

Or, 6x + 4x = 8080

Or, 10x = 8080

Or, x = 8080/10

Or, x = 808

∴ Total SP = 2×6x/5 = 2×6×808/5 = Rs. 1939.2

CP > SP, so there is loss.

∴ Loss = SP – CP = Rs. 1939.2 – 2020 = Rs. 80.8

∴ Loss % = Loss × 100/CP = 80.8×100/2020 = 4%

https://hostinglelo.in As like car games, Bike Games Online are very popular. Bike games are rather more popular among the youngsters especially boys. The reason behind this is the youngsters are more passionate regarding the speed.

ReplyDeletehttps://onohosting.com A new wave of fishing has become a favored pastime and it involves the gaming industry. While fishing is an ancient sport, online fishing games are a new fad and this allows a whole new atmosphere to enjoy the thrill of catching fish. The article discusses the new world of online fishing.

ReplyDeleteA shopkeeper adds 30% on the cost price of any article for m.p and sells allowing 10% discount . If his cost price for an article is Rs 24000 then find its actual selling price.

ReplyDeleteSolution:

DeleteHere,

CP = Rs. 24000

MP = CP + 30% of CP = Rs. 24000 + (30/100) × 24000 = Rs. 31200

Discount = 10%

Actual SP = MP – Discount

= Rs. 31200 – 10% of 31200

= Rs. 31200 – (10/100) × 31200

= Rs. 28080 Ans.

Ananta purchased one scocetage peroter at Rs 65000 and other at Rs.75000. Find his profit and loss percentage if he sold both at the rate of Rs. 72000 each.

ReplyDeleteSolution:

DeleteHere,

Total CP = Rs. 65000 + 75000 = Rs. 140000

Total SP = Rs. 72000 × 2 = Rs. 144000

SP > CP, so there is profit,

Profit = SP – CP = Rs. 144000 – 140000 = Rs. 4000

Profit % = (Profit/ CP) × 100%

= (4000/140000) × 100%

= 2.85% Ans.

A shopkeeper allows a discount of 10% on the marked price , he still makes a gain of 12.5%. By what percent the marked price above the cost price.

ReplyDeleteSolution:

DeleteHere,

MP = x (let)

Discount = 10%

SP = MP – Discount = x – 10% of x = x – 10x/100 = 90x/100

Profit = 12.5%

CP = (100/100 + P%) × SP = (100/100+12.5) × 90x/100 = 90x/112.5

Percent above = (MP – CP)×100%/CP

= (x – 90x/112.5)×100%/(90x/112.5)

= 2250x/90x

= 25% Ans.

A TV was sold at Rs. 43200 by adding 20% VAT after 10% discount. What is the

ReplyDeletediscount allowed on the TV ?

Solution:

DeleteHere,

SP with VAT = Rs. 43200

Discount = 10%

VAT = 20%

By formula,

MP = 100×100×SP with VAT /(100-d%)(100+v%)

= 100×100×43200/(100-10)(100+20)

= 432000000/90×120

= Rs. 40000

Now,

Discount = 10% of MP

= 10×40000/100

= Rs. 4000

Host Humble provides so many plans like "Cheap Web Hosting" , "Low Price Hosting" , "Price Low Hosting" that starts from Rs 60 / per year to Rs 500 / per year. https://hosthumble.com

ReplyDeleteThis article introduces the reasons for that: it explains the advent of governments along with their central banks, then why only the decentralization and fungibility of money can consistently preserve the ownership of monetary value.Teen Patti Hasrat

ReplyDelete